Lynx CDH: Why Consumer-Directed Health Account Administration is Broken & How Lynx is Fixing it

Consumer-Directed Healthcare: a foundational shift that was initially intended to empower individuals to take a more active role in managing their healthcare decisions and expenses, but in reality, has not only confused and burdened individuals by further complicating health and financial management, but has also made it difficult for organizations to administer due to the complex regulatory and product requirement boxes they need to check.

During our time as key executives and decision makers at one of the largest CDH account administrators, Ken, Joe and I dealt firsthand with this complex challenge. Although our goal was to create a simple user experience for consumers, it proved virtually impossible due to battling legacy internal systems and disconnected third-party vendors behind the scenes.

Some of these complexities included:

- A legacy core banking system to manage the blocking and tackling of operating a bank account (after all, an HSA is a bank account combined with a brokerage account). We had not upgraded our core banking system from the initial implementation in the early 2000’s, with technical debt built on top to solve the product and regulatory needs of an ever-changing space ~15 years later.

- A separately managed investment experience, referred out to a detached investment brokerage platform, to ensure we could manage investments on behalf of our customers, but this ultimately created another disconnected backend and front-end experience for the consumer.

- An additional and separately managed CDH account administration platform from our core banking system, including a separate digital experience, sales team, product roadmap and more to support notional accounts (e.g. FSA, HRA).

- Acquisitions of multiple Top 10 CDH account administrators, with their own legacy systems and 3 rd party vendors, that further complicated and inhibited our ability to upgrade our backend and front-end platforms.

Ultimately, we spent most of our time attempting to ensure our legacy systems and 3 rd party vendors could look cohesive, albeit with multiple single sign-on experiences just within our own banking, notional account and investment experiences, to keep the lights on for our millions of customers.

The complexity of doing this ultimately inhibited our ability to simplify the experience for consumers who were just attempting to save time and money, but were further confused by the disconnected nature of simply checking a balance, paying a bill or making an investment trade.

We also recognized another issue: Because of reliance on vendors and third-party solutions, most of the industry CDH administrators were not in control of their experience or product roadmap and had little ability to differentiate their offering to employers. Instead, Bank A’s experience, looked exactly like Health Plan B, which looked exactly like Benefits Administrator C – while all had a desire to get their wish list and roadmaps accelerated by their third-party vendors to have some semblance of differentiation.

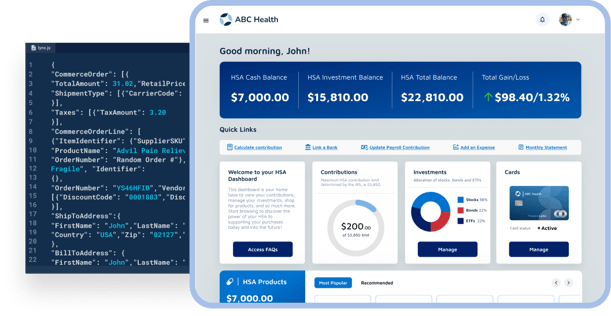

Fast forward to Lynx, and our goal was simple: to introduce the type of consumer banking and payment experience that we expect in our personal lives from our own best-in-class financial experiences into the healthcare savings and payment space.

We started building our solution from the ground up. From building a data model that could serve the needs of the most complex health plans and employers, to creating a ledgering system that can serve the most complex healthcare accounts across HSA, FSA, HRA, ICHRA and more, to ultimately unlocking our technology in the most client- friendly way possible.

The result: a platform that enables any company to own the cohesive CDH experience of the future—one that does not include managing 5 vendors across simple healthcare saving, spending and investing. Instead, Lynx clients can either leverage fully programmatic APIs to build their own workflows to a fully outsourced white-labeled experience across banking, account administration, investments and e-commerce.

Eliminate complex vendor management with Lynx CDH Core. One partner for all your CDH account needs.

Here are 5 key advantages of Lynx CDH Core:

- Customize the CDH experience with programmatic APIs.

- Minimize Customer Friction by removing single sign-ons (SSOs) and website redirects by seamlessly integrating and fully managing CDH accounts within a single customer experience.

- Advanced Payment Processing with physical or virtual cards that are restricted to only accept specific merchant categories, IDs, and even product SKUs at thousands of retailers. Lynx cards can also hold multiple bank accounts and funded benefits, eliminating the need for separate cards for each account type.

- Embed E-commerce APIs to integrate healthcare purchases into CDH account platforms, offering users access to a wide range of FSA- and HSA-eligible products, creating a new revenue stream.

- Embed Investment Functionality allowing companies to curate investment options, simplify trading and fund transfers, and facilitate robo-advisors for managed investments through existing Lynx Registered Investment Advisor (RIA) and broker-dealer partners.

Lynx Helps Medicare Advantage Plan Accelerate SDOH Spend and Member Satisfaction

Keep Up with Us

Sign up for Lynx's newsletter and get the latest posts delivered to your inbox

More to Explore

In today's digital age, managing a..

Check Out the Lynx Sandbox In the Lynx Sandbox..

If you've been keeping up with the latest trends..